taxes in retirement 567 reviews

Helen Karen an expert online trader i red some reviews about her good works in trading and i decided to give it a try which came out great with an investment of 1500 and. Of course many households pay a lot more and some people pay nothing at all depending on your income level.

Taxes In Retirement 567 Home Facebook

Understand the potential impact taxes have on your retirement income.

. To achieve this goal we need to understand the impact of taxes on our retirement income. Taxes In Retirement 567 is an educational resource for. Since each persons tax.

Retirement 567 is not associated with the Social Security Administration or any Government Agency. Taxes In Retirement 567 is not associated with the Social Security Administration or any Government Agency. This unbelievable investment is so profitable and real with Mrs.

Zip - or -. Taxes in Retirement 567 Seminar Review. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

The leading vendors are. Up to 3 cash back Since each persons tax situation is unique and the tax rules can change year to year it can be challenging to get accurate and timely information. Call Us Toll Free.

Taxes in Retirement 567 Birmingham Michigan. The goal is to have a comfortable and rewarding retirement lifestyle. Retirement-age fraud victims tend to lose more money to scams than younger victims.

Taxes in Retirement 567 Birmingham Michigan. According to the 2017 Retirement Confidence Survey only 35 of workers aged 55 or older had retirement savings of 250000 or more meaning that many millions have less. Social Security 567 and Taxes In Retirement 567.

Social Security 567 and Taxes In Retirement 567. 36109 likes 2234 talking about this. Fidelity Investments 866-345-1388.

While theyre only a handful of companies that sell direct you instantly save on commissions. THE NEW TAX AND FINANCIAL RULES HAVE CHANGED. Do you have a retirement tax strategy.

How lost deductions may affect your taxes in retirement. Its important to consider how taxes could gnaw away at your nest egg once you reach your golden years The more strategies you can put in place to eliminate or minimize your tax bill the more money you can leave in your nest egg to continue growing. Ad Download the free guide learn more about the 6 crucial post-retirement income streams.

If youre nearing retirement or already retired you need to understand how taxes including the new changes impact your retirement income as it may be possible for you to pay less in taxes on your hard-earned dollars. No Matter What Your Tax Situation Is TurboTax Has You Covered. Taxes In Retirement 567 is an educational resource for those nearing retirement.

Taxes In Retirement Webinar - Clark County. Taxes In Retirement Webinar - San Mateo County CA. Common misconceptions about taxes in retirement.

The median fraud loss was 500 for victims in their 60s 621 for victims in their 70s and 1092 for victims. Get our free guide discover 6 sources of post-retirement income you should know. Understand the potential impact taxes have on your retirement income.

December 28 2021 at 454 PM. Monday April 18 2022 1130 AM. That is why weve developed a special webinar that has already helped nearly 70000 people nationwide navigate the retirement tax maze.

First I wondered what 567 meant in. Join us at Alcott Center for an informational seminar and Insurance Sales Presentation covering Taxes In Retirement on Thursday May 16 from 630-800 PM in Room 24 or Saturday May 18 from 1100 AM-1230 PM in Room 6. A basic overview of the tax rules as they apply today.

Possible tools and strategies available to help develop a retirement tax strategy. Retirement is rated one of lifes most stressful events. Our seminar will equip you with the most up-to-date and comprehensive information regarding retirement taxation including.

Hours Mon-Fri 9am-9pm EST Sat-Sun 9am-5pm EST. Monday April 18 2022 1130 AM. At a Taxes in Retirement 567 seminar you will learn.

Fehintolar Egbayelo Ojomo recommends Retirement Income Planning 567. Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and local. 76 Taxes in Retirement Webinar - Baltimore County.

35204 likes 2395 talking about this 491 were here. Taxes in Retirement 567 - Facebook. Retirement Income Planning 567.

Taxes In Retirement 567 Home Facebook

Taxes In Retirement 567 On Demand On Vimeo

Taxes In Retirement 567 Taxes In Retirement Seminar In Hamilton Facebook

Ecuador 2021 Article Iv Consultation Second And Third Reviews Under The Extended Arrangement Under The Extended Fund Facility Request For A Waiver Of Nonobservance Of Performance Criterion And Financing Assurances Review Press Release

Retirement Income Planning 567 Home Facebook

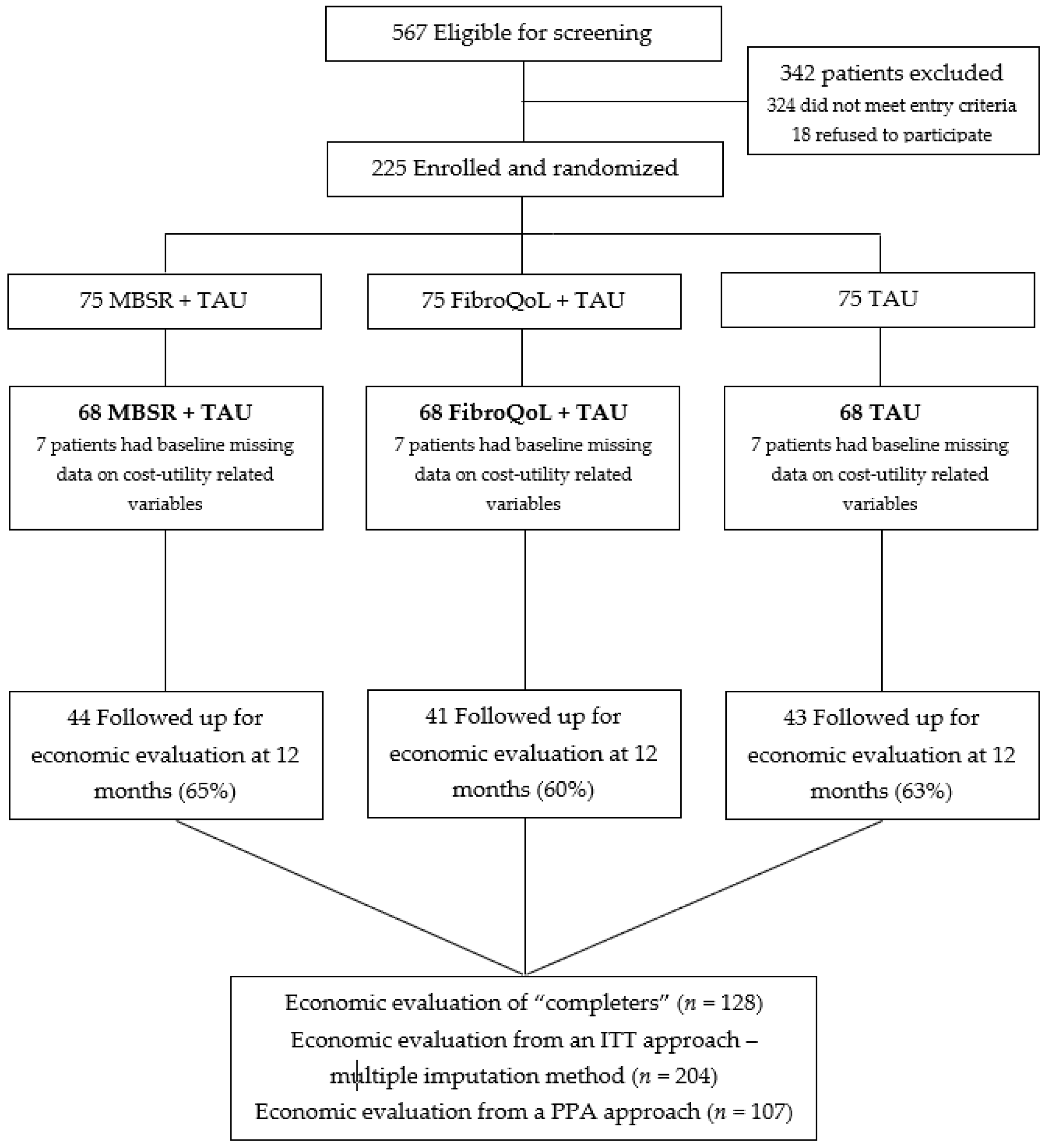

Jcm Free Full Text Cost Utility Of Mindfulness Based Stress Reduction For Fibromyalgia Versus A Multicomponent Intervention And Usual Care A 12 Month Randomized Controlled Trial Eudaimon Study Html

Solved Julio And Maria Gomez Are Retired And They Live At 567 Ono Way Course Hero

Does Your Credit Score Matter The Finance Twins Credit Score Finance Managing Your Money

Taxes In Retirement 567 Privacy

Social Security 567 And Taxes In Retirement 567 Reviews Better Business Bureau Profile

What Impact Will Taxes In Retirement Have On Your Retirement Income Have You Thought About A Retire Retirement Income Area Of Expertise Financial Independence

Retirement Income Planning 567 Home Facebook

Retirement 567 Workshop Youtube

Retirement 567 Workshop Youtube

Advice Insights Mark Singer Your Retirement Guide

Taxes In Retirement 567 Home Facebook

Create And Implement A Customized Automated Cash Flow System To Make Monthly Saving And Investing For Retire Cash Flow Investing For Retirement Monthly Savings